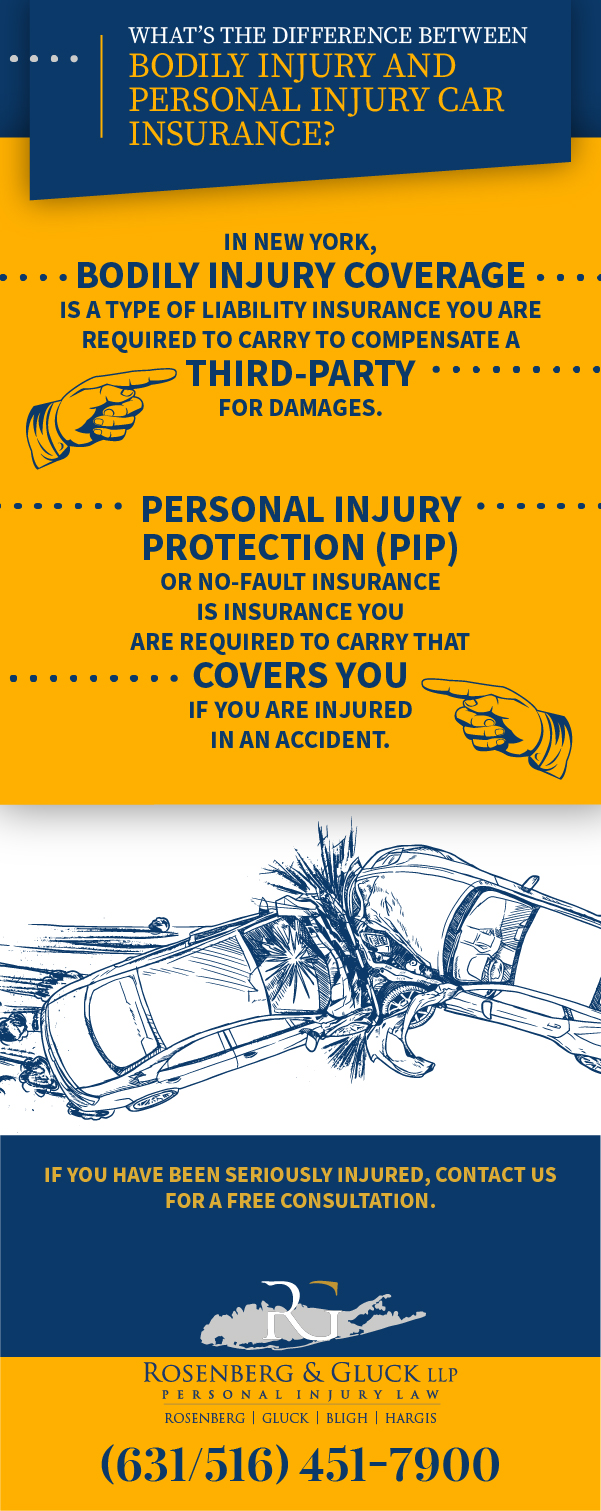

Understanding the difference between bodily injury and personal injury car insurance is important to your safety.

In New York, bodily injury coverage is a type of liability insurance you are required to carry on your car insurance to compensate a third party for damages if you were responsible for an accident. Personal Injury Protection (PIP) insurance, also known as no-fault insurance, is a different type of insurance you are required to carry on your car insurance that covers you if you are injured in an accident.

New York State law requires drivers to carry a minimum of $25,000 in bodily injury coverage and $50,000 in personal injury protection coverage.

For a free legal consultation, call 631-451-7900

Bodily Injury vs. Personal Injury Protection

What is the difference between a bodily injury and a personal injury claim? Bodily injury refers to bodily injury insurance, which is liability insurance that pays for damages to a third party if you are at fault in an accident. In the context of car insurance, personal injury refers to personal injury protection (PIP) insurance coverage, which will pay for your own medical expenses and other economic losses regardless of who is at fault.

Required by New York Law

Both types of auto insurance policies are required by New York State law. Understanding the differences between these two types of auto insurance is essential to make sure you have the coverage you need in case of an accident.

Bodily Injury Liability Coverage

Bodily injury liability insurance coverage protects you and anyone who has permission to drive your car if an accident claim is made against you by another third party. This type of insurance policy coverage will make payments on your behalf to a third party if your car is involved in an accident that results in serious injury, death, or damage to someone else’s property.

Legal Defense

A bodily injury liability insurance policy will also ensure that your insurance company will provide you with a legal defense against a bodily injury claim alleging that you were negligent or at fault for an accident.

Bodily Injury Liability Coverage Minimums in New York

In New York, the minimum coverage limits for bodily injury liability coverage and property damage liability are often referred to as 25/50/10. These minimum coverage limits determine how much coverage you need and include:

- $25,000 for bodily injuries that do not result in death or $50,000 for an injury that results in death, which is sustained by a person injured in an accident;

- $50,000 for physical injuries that do not result in death sustained by two or more people involved in an accident or $100,000 for an injury that results in the death of two or more accident victims;

- $10,000 for property damage liability protection to compensate a third party for damage to their property.

Click to contact our personal injury lawyers today

Personal Injury Protection (PIP) Coverage

PIP or No-Fault coverage in New York is designed to pay for your economic losses from a car accident regardless of who is at fault and whether or not there was any negligence. It will pay up to $50,000 per person to the driver and any passengers who were injured as well as to injured pedestrians.

Types of Economic Damages Covered by PIP in a Personal Injury Cases

This type of policy will cover economic losses including medical bills, healthcare and medical expenses, and lost wages. It will also cover other reasonable and necessary expenses related to the injuries sustained in the accident by the driver, passenger, or pedestrians.

What Basic No-Fault Auto Insurance Covers

After a motor vehicle accident, New York No-Fault will cover you for:

- Reasonable and necessary medical expenses related to the injuries you suffered in your accident, and No-Fault is primary to your health insurance and will pay your medical bills first

- 80% of your lost income up to a maximum of $2,000 per month for up to three years from your car accident

- A reimbursement up to $25 per day up to a year after the crash for other reasonable and necessary expenses, which could include things like housekeeping help and transportation expenses

- A $2,000 death benefit paid to the estate of the person killed in an accident, which is in addition to the $50,000 No-Fault per person limit

What PIP Doesn’t Cover

Economic losses due to a serious injury that exceeds the No-Fault benefits limit of $50,000 will not be covered by PIP insurance. These damages may be recovered in a personal injury lawsuit along with other non-economic damages like pain and suffering, loss of enjoyment of life, scarring and disfigurement, and more.

No-Fault also does not pay for property damage like auto body repair work on your damaged car or compensation for the other driver’s wrecked car. It also does not cover motorcyclists.

Ineligibility for No-Fault Benefits

Under most insurance policies, a person could be ineligible for No-Fault benefits if they were:

- drunk driving or driving under the influence of drugs;

- committing a felony or fleeing from the police;

- in a stolen vehicle or one that is not insured adequately;

- intentionally causing the injuries; or

- riding a motorcycle or ATV as the driver or a passenger.

Complete a Free Case Evaluation form now

How to Seek Additional Compensation for a Serious Physical Injury

If your damages exceed the limits of your PIP coverage, you might be able to seek additional compensation for a serious injury by filing a personal injury lawsuit. A personal injury lawyer from Rosenberg & Gluck, L.L.P. can help you understand your rights and options for personal injury claims under New York State law if you have been seriously injured in an accident.

Call Our Personal Injury Law Firm Today

If successful, a personal injury claim could recover compensation and provide financial relief that would otherwise not be available through your PIP coverage. Call the personal injury attorneys at Rosenberg & Gluck, L.L.P. today for a free legal consultation to discuss your personal injury case with our Long Island personal injury lawyers.