In this series, we are covering the questions we hear most often about New York’s no-fault benefits from auto insurance. New York along with 11 other states and Puerto Rico have no-fault auto insurance laws that require drivers to purchase personal injury protection as part of the policy. The details of these laws and extent of no-fault car insurance coverage vary from state to state.

For a free legal consultation, call 516-451-7900

No-Fault Coverage in New York

In New York State, if you are in an accident, the insurance company of the vehicle you were in (as a driver or passenger) must cover up to $50,000 of your lost wages and medical bills. This coverage is called “no-fault” and is required by New York State law. Every automobile insurance policy issued in New York must include a mandatory minimum of $50,000 in personal injury protection (PIP).

Who Is a Covered Person?

This coverage extends to a “covered person” who is injured as the result of a “covered accident.” A covered person is defined as someone who owns, operates, or is a passenger in a vehicle. You are also covered if you are a cyclist or pedestrian injured by a vehicle.

It is important to note that if you operate a motorcycle or are a passenger on a motorcycle, you are not covered.

What Is a Covered Accident?

Covered accidents are defined as an incident that occurs while using or operating a vehicle. This could include a multi-car pileup on the Long Island Expressway, a pedestrian struck by a van at a crosswalk, or a single car hitting a telephone pole.

Qualifying for No-Fault Benefits

After an accident, you must immediately notify the insurance carrier in order to qualify for no-fault benefits. After you notify the carrier that the accident occurred and that you suffered an injury, they will send you a no-fault application to complete to file a claim. This application must be returned within 30 days of the accident in order to receive no-fault benefits.

Hiring an experienced auto accident attorney to help with this process can make a difference in ensuring you get the coverage you seek. It is important to remember that sometimes you may be notifying a carrier other than your own.

For example, if you are injured while you are a passenger in a friend’s car, you would notify your friend’s insurance company that you are hurt. If you are a pedestrian and are injured by a van while crossing the street, you would notify the van’s insurance company that you were injured. If you were in an accident and are hurt while driving your own car, you’d notify your own insurance company of the accident and your injuries.

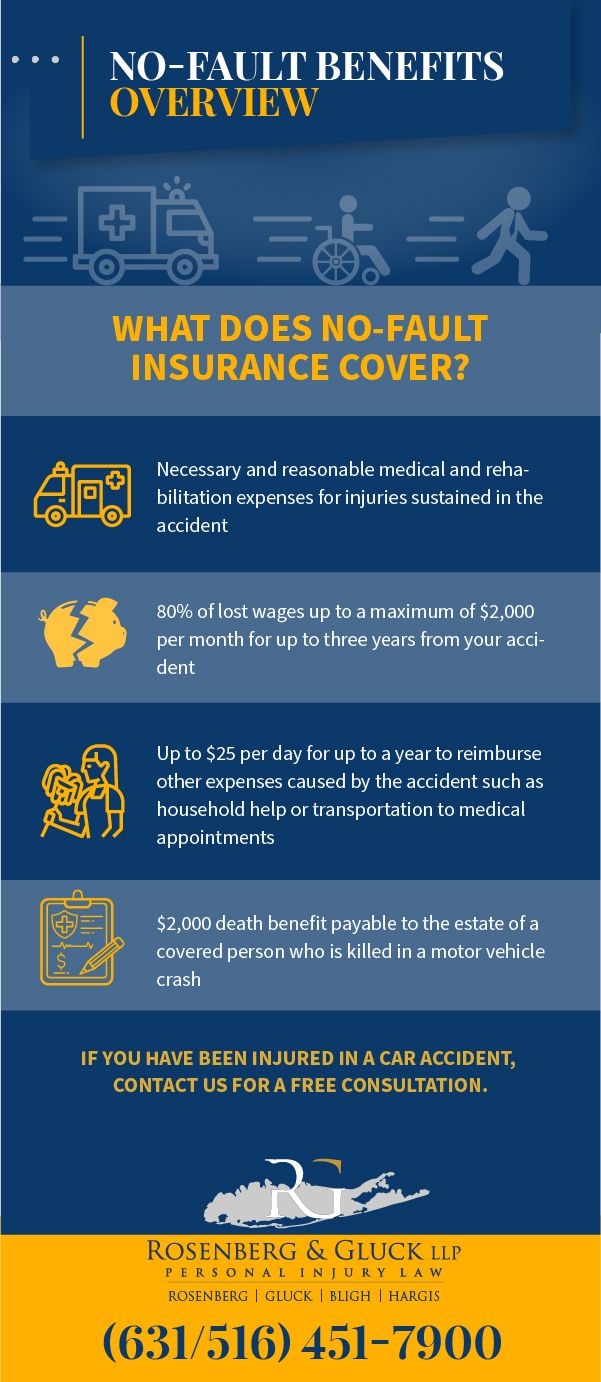

What Does No-Fault Insurance Cover?

In New York State, basic no-fault auto insurance will cover the following:

- Necessary and reasonable medical expenses and rehabilitation expenses for injuries sustained in the accident

- 80% of lost wages up to a maximum of $2,000 per month for up to three years from your accident

- Up to $25 per day for up to a year to reimburse other expenses caused by the accident such as household help or transportation to medical appointments

- $2,000 death benefit payable to the estate of a covered person who is killed in a motor vehicle crash

Under most policies, a person will not be eligible for no-fault car insurance benefits after an auto accident if any of the following criteria are met:

- Driving while intoxicated

- Intentionally causing the accident and their own bodily injury

- Riding a motorcycle or ATV as the operator or as a passenger

- Injured while committing a felony

- Injured while knowingly driving or riding in a stolen vehicle

- An owner of an uninsured vehicle

the experienced car accident lawyers at Rosenberg & Gluck.